Calculating roi in real estate

Homeowners should measure square footage to get an accurate assessment of their propertys size. Common Mistakes in Calculating ROI.

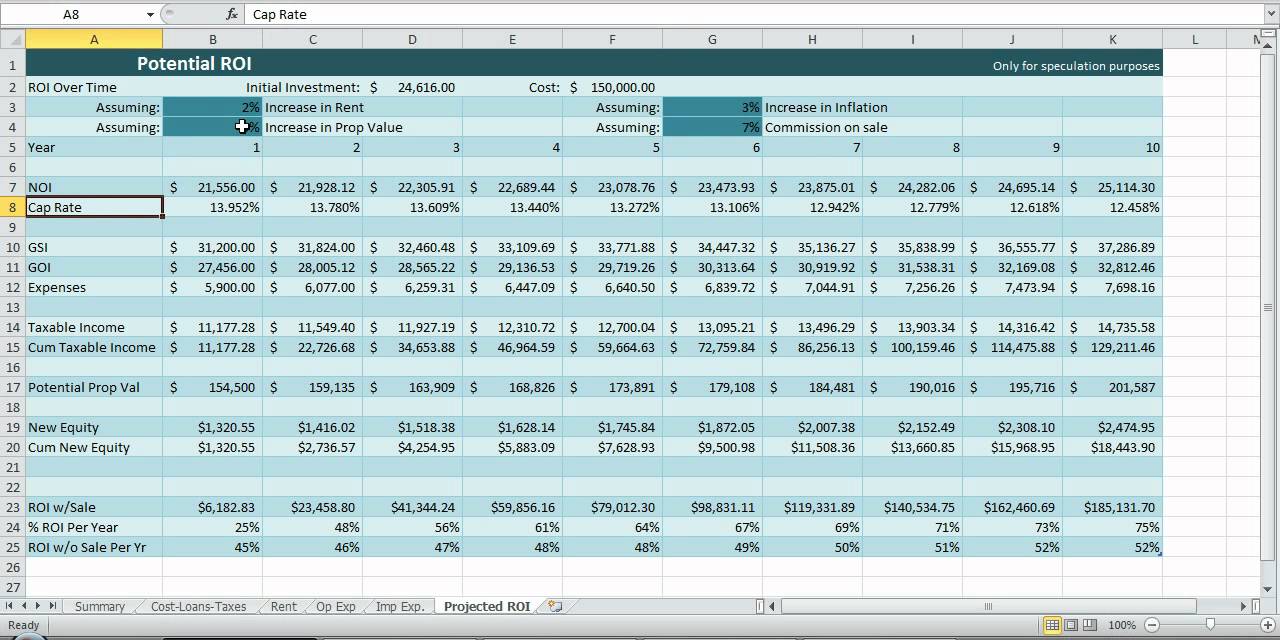

Investment Property Excel Spreadsheet Rental Property Rental Property Investment Investment Property

Why Pro Forma in Real Estate is Important.

. This is less than Investment Bs annual return of 10. Important to note is that the DCF valuation method requires a business plan which can be subjective and at least 5 years of forward-looking financial projections. As you can imagine these changes will significantly inflate balance sheets and could potentially impact the comparability of business valuations in the short-term.

An ROI return on investment. After 3 years 20 x 1062659 x 1062659 x 1062659 24. Real Estate Property consisting of land or buildings.

The owners have an asking price of 200000 for the home. To check if the annualized return is correct assume the initial cost of an investment is 20. If spending 50000 on advertising generated 750000 in sales the business owner would be getting a 1400 ROI on the ad expenditure.

Real estate market analysis vs. By investing in the CD youd be falling 626 short of keeping pace with current inflation rates. Is this a good deal.

GIGO is an acronym for garbage in garbage out In computer science GIGO refers to the fact that if input data is flawed the output will be complete nonsense or garbage. Solving for x gives us an annualized ROI of 62659. If you are a new landlord or already a seasoned investor calculating your return on a potential real estate investment is a necessity and that is where a rental property calculator can help.

Whether youre investing in Tampa or Seattleor trying to decide between two different areasa proper market assessment is essential. Real Risk-Free Rate 204 83 So the real risk-free rate is -626. As mentioned earlier calculating ROI for a rental property can get a little tricky as it typically measures the returns based on the eventual sale price of a property.

Total ROI considers all. Commercial real estate valuation also helps protect you from getting involved with loss-inducing properties or overpriced assets. Real estate investing is not a get-rich-quick scheme and it can take decades before you see results.

ROI allows investors to predict based on comparables the profit margin they should realize on their real estate either through flipping homes or renting properties as a. Educate yourself invest wisely and design a strategic plan of action that includes real estate as part of your overall wealth plan here. The square footage will directly influence the purchase price and it could make a big difference when marketing the.

Multiply the result by 100 to get the ROI on real estate investment. Thats why real estate investors use a pro forma to make sure their financial projections are as accurate as possible. A higher ROI number does not always mean a better investment option.

What does 30 ROI mean. The DCF valuation method is widely used for business valuations real estate properties and assets such as brands patents or trademarks. In the process youll develop a scorecard to compare strengths and weaknesses and opportunities and risks of different real estate markets.

Below are two key points that are worthy of note. COC only considers cash flows financial impact. Lets set the stage.

Return on investment ROI is a metric that helps real estate investors evaluate whether they should buy an investment property and compare apples to apples one investment to another. Its a home in your area that the owners are moving out of and need to sell. The most obvious reason homeowners will need this information is for a property value estimation when they sell their house.

For those unfamiliar or new to rental property investments a residential rental property is a home that is purchased by a property investor and then leased out to tenants who pay rent. However there are ways to get around calculating ROI on a rental property explained in detail here. Commercial real estate appraisal can be nuanced and subjective.

Similarly a real estate owner mulling new appliances might. For instance for a potential real estate property investor A might calculate the ROI involving capital expenditure taxes and insurance while investor B might only use the. Real Estate Calculator Terms Definitions.

When calculating ROI its important to take into consideration other factors that may be less obvious such as time hidden costs and fees and even emotional factors such as stress. ROI 1200 2000 06 or 60. The formula for calculating ROI is ROI Net gain Cost of investment.

Because the real estate market is volatile you may not be able to predict this. Calculating the Gross Rent Multiplier Approach goes like this. While the ratio is often very useful there are also some limitations to the ROI formula that are important to know.

You receive a call from your real estate agent and informs you of a property that has become available. And dont forget your tenants rent pays off the property. All of these things can significantly impact your ROI.

1 The ROI Formula Disregards the Factor of Time. Under ASC 842. Or resell- whatever you need to do to generate your ideal ROI.

Why Measure Square Footage. While the ROI formula itself may be simple the real problem comes from people not understanding how to arrive at the correct definition for cost andor gain or the variability involved. It is expected that you could safely ask 1400 as monthly rent.

However determining ROI can be a bit more complex than a simple math equation. Keep in mind that this is just one lease among a potentially large portfolio of leases for real estate equipment and more. Using the values 1200 and 2000 in the formula we will get.

ROI 24 20 20 02 20. For example two investments have the same ROI of 50.

How To Calculate Roi On A Rental Property To Find Great Investments Real Estate Investing Investing Real Estate Investing Investment Property

Calculate Return On Investment For A Rental Propertyhttps Iqcalculators Com Calculator Real Estate Investing Financial Calculators Investment Companies

Pin On Real Estate Info

Forget Everything You Ve Heard About What Is A Good Cap Rate Investment Property In 2022 Real Estate Investing Rental Property Real Estate Investing Real Estate Tips

Rental Property Investment Calculator Roi Noi And Cap Rate Analysis Google Sheets Excel Versions Digital Download

Rental Property Tool Ms Excel Spreadsheet Income Expense Etsy Budget Planner Template Excel Spreadsheets Rental

Pin On Financial Ideas

Real Estate Investment Spreadsheet Template Spreadsheet Template Spreadsheet Real Estate Investing

Airbnb Rental Property Investment Financial Model Profits Etsy In 2022 Rental Property Investment Investment Property Investing

Investment Property Spreadsheet Real Estate Excel Roi Income Noi Template Youtube Real Estate Investing Books Investing Books Investing

Investing Rental Property Calculator Real Estate Investing Rental Property Rental Property Management Real Estate Investing

Roi Calculator Formula Investing Financial Management Online Advertising

Rental Property Tool Ms Excel Spreadsheet Income Expense Etsy Budget Planner Template Excel Excel Spreadsheets

Rental Property Roi And Cap Rate Calculator And Comparison Spreadsheet Template

Tenant Payment Ledger Remaining Balance Rent Due Calculator 25 Properties Rental Property Management Rental Property Rental Income

Rental Property Roi Cap Rate Calculator Real Estate Etsy Uk

Investing Rental Property Calculator Roi Mls Mortgage Cash Flow Statement Investing Mortgage Refinance Calculator